Hi Friends! Your are welcome in My Tech Buddy Blog.Keep Updated With day to day Technology And I hope if you liked it then share and follow me for this type of contents if you want and please do comment that on which topic should I write Thanks you all!Share it more!

Today' tech news highlights-Moto G6 Plus With 6GB RAM, Dual Rear Cameras Launched in India: Price, Specifications, More, Microsoft Store apps were suddenly updated yesterday,and more.

Moto G6 Plus With 6GB RAM, Dual Rear Cameras Launched in India: Price, Specifications, More

Today' tech news highlights-Moto G6 Plus With 6GB RAM, Dual Rear Cameras Launched in India: Price, Specifications, More, Microsoft Store apps were suddenly updated yesterday,and more.

Moto G6 Plus With 6GB RAM, Dual Rear Cameras Launched in India: Price, Specifications, More

The Moto G6 Plus price in India has been set as Rs. 22,499

Moto G6 Plus has become the latest smartphone to join the ever-growing list of affordable handsets in the Indian market. The new Moto G6 Plus joins its siblings Moto G6 and Moto G6 Play, which were launched in in the Indian market in June this year. It was unveiled globally in April, and has a bigger display, more RAM, and faster processor than its two siblings and sits on top of the Lenovo-owned brand’s G6 series. The India variant, in fact, comes with 6GB of RAM, compared to 4GB of RAM in the international variant.

Moto G6 Plus price in India

Moto G6 Plus price in India has been set as Rs. 22,499 for the sole 6GB RAM, 64GB internal storage variant. It will go on sale via Amazon.in, Moto Hubs, and Motorola's offline retail partners starting today. The smartphone will only come in Indigo Black colour. Launch offers (only available offline) for Paytm Mall customers include Rs. 3,000 cashback for purchases made using the app. Jio users will get cashback of Rs. 4,450 on recharges of Rs. 198 and Rs. 299 (instant cashback Rs. 2,200, Cleartrip cashback vouchers worth Rs. 1,250, and Ajio.com discount worth Rs. 1,000). Buyers will also get no-cost EMIs from Bajaj FinServ.

Moto G6 Plus specifications

Now coming to the specifications, Moto G6 Plus sports a 5.93-inch display with 18:9 aspect ratio and full-HD+ (1080x2160 pixel) resolution. Based on stock Android 8.0 Oreo, with Android Pie update promised to be coming soon, the dual-SIM (Nano-SIM) phone runs on the 2.2GHz octa-core Snapdragon 630 processor, with Adreno 508 GPU and 6GB RAM. In optics, there is a dual rear camera setup with 12-megapixel primary sensor featuring 78-degree lens and f/1.7 aperture, and a secondary camera with 5-megapixel sensor having 79-degree lens and f/2.2 aperture In the front is an 8-megapixel camera with 80-degree lens and f/2.2 aperture. The phone has dual-tone, dual-lens LED flash on the back, and a selfie flash in front.

When it comes to storage, buyers will get 64GB of internal storage and microSD support up to 128GB. Connectivity suite of the smartphone includes 4G LTE, Wi-Fi, Bluetooth 5.0, USB Type-C, NFC, 3.5mm audio jack, and the usual set of sensors. The Moto G6 Plus battery capacity is 3,200mAh, with support for Motorola’s TurboPower adaptor (which is claimed to deliver 7 hours of use on a charge of 15 minutes). The handset is listed in Indigo and Gold colours, measures 159.9x75.5x7.99mm, and weighs 165 grams.

This is why all your Microsoft Store apps were suddenly updated yesterday

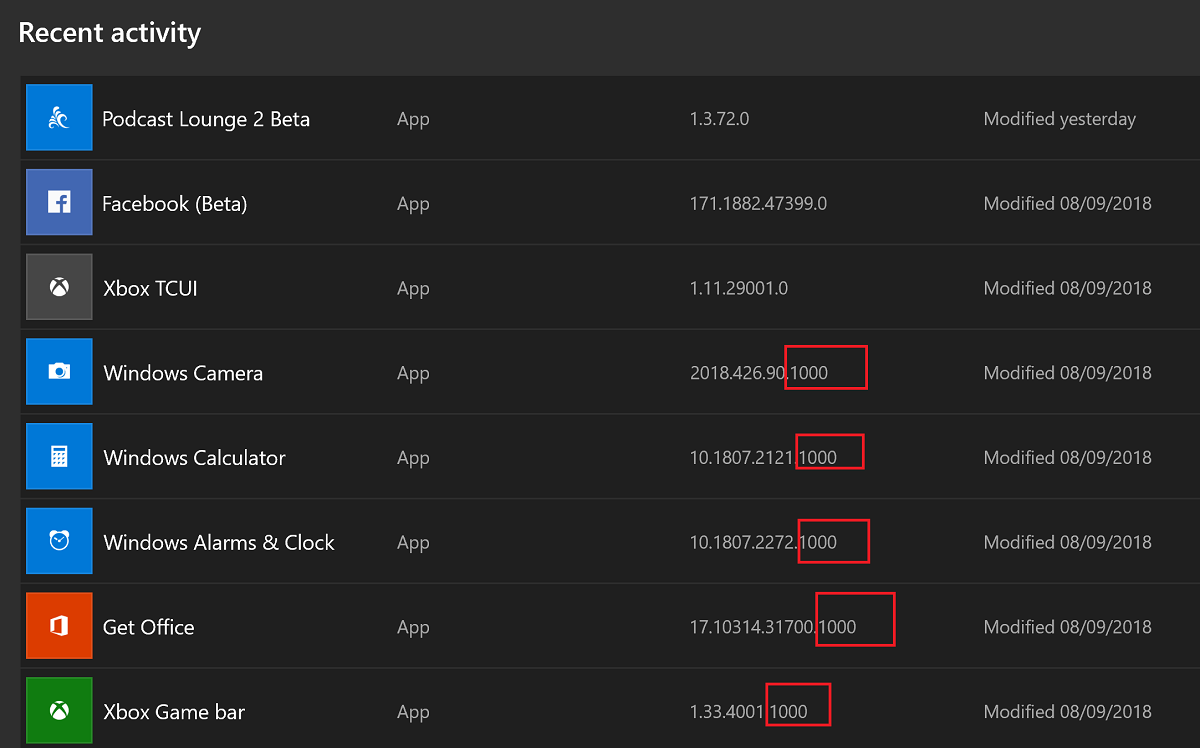

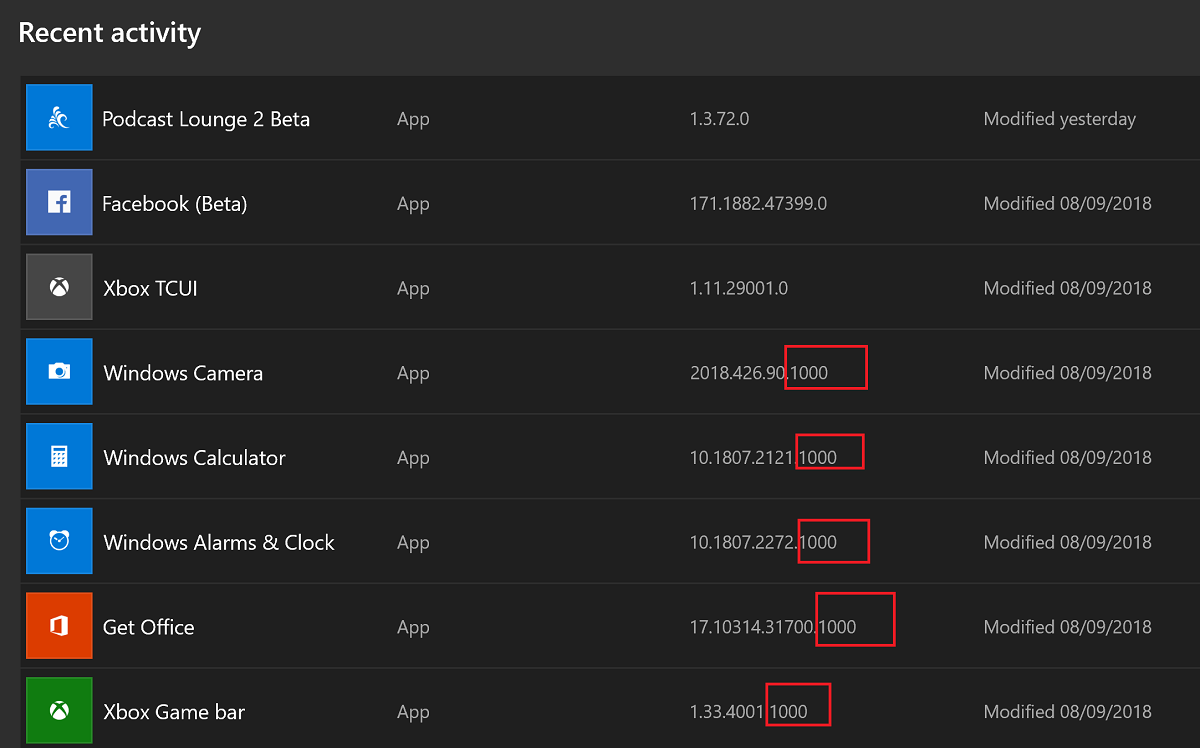

You may have noticed a rash of app updates in the Microsoft Store over the last few days. The reason is not a sudden dedication to supporting their apps by Windows developers, but rather Microsoft fixing an issue with the Store.

The issue had caused users to run into error 0x800B0100 when they try and download apps, with Palani Sundaramurthy, a Principal Program Manager Lead on Developer & Partner Services at Microsoft saying:

“We have tracked this issue to our submission workflow incorrectly signing certain apps. [We need] to re-process the impacted apps in order to alleviate the problem. While we have already re-processed a few apps, […] we’re working to ensure that every impacted app is fixed.”

The reprocessed apps are all showing up as app updates with the minor version number of .1000. The fix appears to have resolved the issue, with Microsoft reporting that developers can now safely resubmit apps and expect end users to be able to download them.

Global Paper Machine Systems Market 2018 Leads with Comprehensive Gross Margin by 2025 : Leading Companies, Seiko Epson Corporation, Voith GmbH

The Global Paper Machine Systems Market appears as the most significant market which strongly impacts on the global economy. Paper Machine Systems market acts as a vital element of the industry. Paper Machine Systems Market is being habitually developing its technological advancement to set a formative stance in the global industry.

Paper Machine Systems Market Research Report presents an overarching market and vendor landscape including a SWOT analysis of the global leading vendors. The report also covers the present scenario and the enlargement prospects of the market for 2018-2023.

Key market players operating in the Global Paper Machine Systems Market:

- ABB Ltd

- Seiko Epson Corporation

- Forbes Marshall

- MAN Diesel & Turbo Schweiz AG

- Voith GmbH

- BW Papersystems (A Barry-Wehmiller Company)

- Popp Maschinenbau GmbH

- Rockwell Automation, Inc.

- TMEIC

- Runtech Systems Oy

Most widely used downstream fields of Paper Machine Systems market covered in this report are:

- Pulping and Fiber

- Energy Production

- Others

Paper Machine Systems Market segregated into Regions as follows :

- North America

- Asia-Pacific

- Europe

- South America

- Middle East

- Africa

For More Detailed Information regarding Companies, Types and Applications visit : https://www.marketresearchexplore.com/report/global-paper-machine-systems-market-research-report-2018/131755

The report offers a primary panorama of the Paper Machine Systems industry which encompasses segmentation, definitions, applications, key vendors, market drivers and market challenges. The report comprises the international market competitive landscape review, development trends, and key regions development status.

Detailed TOC of Report:

- Paper Machine Systems Introduction and Market Overview, Market Segmentation

- Industry Chain Analysis, Market Scope, and Market Size Estimation

- Market Concentration Ratio and Market Maturity Analysis

- Market Dynamics, Drivers, Emerging Countries, Opportunities, Industry Policies

- Paper Machine Systems Production Value ($) and Growth Rate (2012-2017)

- Production, Consumption, Export, Import by Regions (2012-2017)

- Status and SWOT Analysis by Regions

- Industry Chain Analysis, Upstream Raw Material Suppliers, Production Process Analysis

- New Project Feasibility Analysis, Industry Barriers and New Entrants SWOT Analysis, Analysis and Suggestions on New Project Investment

Rupee has depreciated, and appreciated too

The rupee on Monday plunged to a new low of 72.67 against the US dollar, losing 94 paise from the previous closing mark. Forex dealers said besides strong demand for the American currency, buying by importers, mainly oil refiners in view of surging crude oil prices, and capital outflows, weighed on the domestic currency.

Despite the weakening of rupee, it has held fort against most of the currencies. Here is an explainer on how not all is gloom and doom with the Indian currency:

IS RUPEE THE WORLD'S WEAKEST CURRENCY AT PRESENT?

Although the Indian rupee has fallen significantly against the American dollar, it is not the weakest currency. If one compares the exchange rate over a five-year period, it works out that the rupee has appreciated against most currencies.

Despite the weakening of rupee, it has held fort against most of the currencies. Here is an explainer on how not all is gloom and doom with the Indian currency:

IS RUPEE THE WORLD'S WEAKEST CURRENCY AT PRESENT?

Although the Indian rupee has fallen significantly against the American dollar, it is not the weakest currency. If one compares the exchange rate over a five-year period, it works out that the rupee has appreciated against most currencies.

Impact of the rupee's weakening will be diverse and will also depend on issues such as a particular company's reliance on exports, its cost base, and its exposure to pricing on international markets.

Global rating agency Moody's Investors Service on Monday said that a sustained weakening of the rupee would be credit negative for its rated Indian companies.

It will have an adverse impact particularly on those entities that generate revenue in rupees but rely on US dollar debt to fund their operations and have significant dollar-based costs, including capital expenses.

"The Indian rupee hit a new low of Rs 72.1 to the US dollar on Thursday and has now weakened around 13 per cent since the beginning of 2018," said Annalisa DiChiara, Moody's vice-president and a senior credit officer, in a statement.

"Nevertheless, most rated Indian-based corporates have protections in place -- including natural hedges, some US dollar revenues and financial hedges -- to limit the negative credit implications of a potential further 10 per cent weakening of the rupee to the US dollar from Thursday's rate," says DiChiara.

"Furthermore, the impact of the rupee's weakening will be diverse and will also depend on issues such as a particular corporate's reliance on exports, its cost base, and its exposure to pricing on international markets," Moody’s said.

Moody's comments follow its annual survey of the US dollar debt exposures of South and Southeast Asian high-yield companies which considered the effects of a weakening of the rupee to around Rs 78 to the US dollar.

Weaker credit metrics -- under a scenario of a further 10 per cent drop in the value of the rupee from the rate on September 6-- can be accommodated in the companies' current rating levels, according to the Moody's report.

Furthermore, refinancing risk associated with the companies' US dollar debt maturing over the next 12 months is manageable.

Of the 24 Moody's rated Indian-based corporates, 12 generate most of their revenue in US dollars or have contracts priced in US dollars, providing a natural hedge. This limits the effect a weakening in the rupee could have on their cash flows.

The cost base for these companies -- which includes those in IT -- is also largely rupee denominated, meaning they could see some cash flow benefit from currency mismatches. However, weak industry fundamentals, including rising competition, pricing pressure and increasing employment costs would mute any overall benefit for most.

Seven rated oil and gas companies also fall under the "naturally hedged" category. Although they rely on foreign-currency debt, their earnings are linked to the US dollar because crude oil, natural gas, petroleum products and petrochemicals are all sold at US dollar-linked prices in India. This provides a natural hedge to their US dollar-denominated borrowings, it added.

Comments

Post a Comment

You can write your query here!